We help clients solve an

Epic Problem.

There is a misconception in the middle-market that healthcare costs are not controllable, and that is simply not true.

Controlling Total Cost of Benefits

- Companies have been led to believe that yearly rising healthcare costs are something they have to accept

- They have been told that self-insuring is too risky

- They tend to believe that self-insured programs are only for large organizations

Healthcare Benefits for Groups down to 50 Employees

Cogent Advisors

Our purpose at Cogent Advisors is to help organizations improve their current & future enterprise value via several strategies, a primary one coming through our Employee Benefits Advisory Services. We accomplish this goal with our clients per the plan we outline at the outset of every relationship.

5 Questions to Consider

1. Are you looking for creative ways to free up additional capital?

2. Are you absolutely sure you are getting the best plan and cost reduction options?

3. Is your agent improving the current & future Enterprise Value of your organization?

4. Do you feel like your current agent is fully transparent with you?

5. Does your agent communicate how they earn their commission?

Is it reasonable to

Expect more?

Your employee benefits are probably one of the top three expenses for your company, so who you choose to help

control those costs matters.

We believe you should expect more from your benefits advisory firm. You deserve a partner to give you a strategic advantage saving you time, energy and money.

How we work

- Drive current and future enterprise value

- Transparent on commission income

- Quarterly agency report cards

- Clearly documented and followed service model

- Defined & measured strategic and tactical objectives

The Solution?

Improve Current & Future Enterprise Value

What if…

What if you had access to Strategic & Tactical resources to truly improve your current & future enterprise value? What value could you place on the following?

%

Annual Dividend

%

10 - 15% Initial Reduction of Healthcare Costs

%

Annual Premium Increase

The Process

Our process is the infinite path we use to continually improve our client’s current and future enterprise value.

We are always working on an evolving plan structured within our D-D-I-M process. Our icon and logo were intentionally developed to illustrate that our work is always ongoing and it never ends.

Almost anyone in the country can get a benefits license to sell a group policy. Our clients deserve and demand much more. Perhaps you do too.

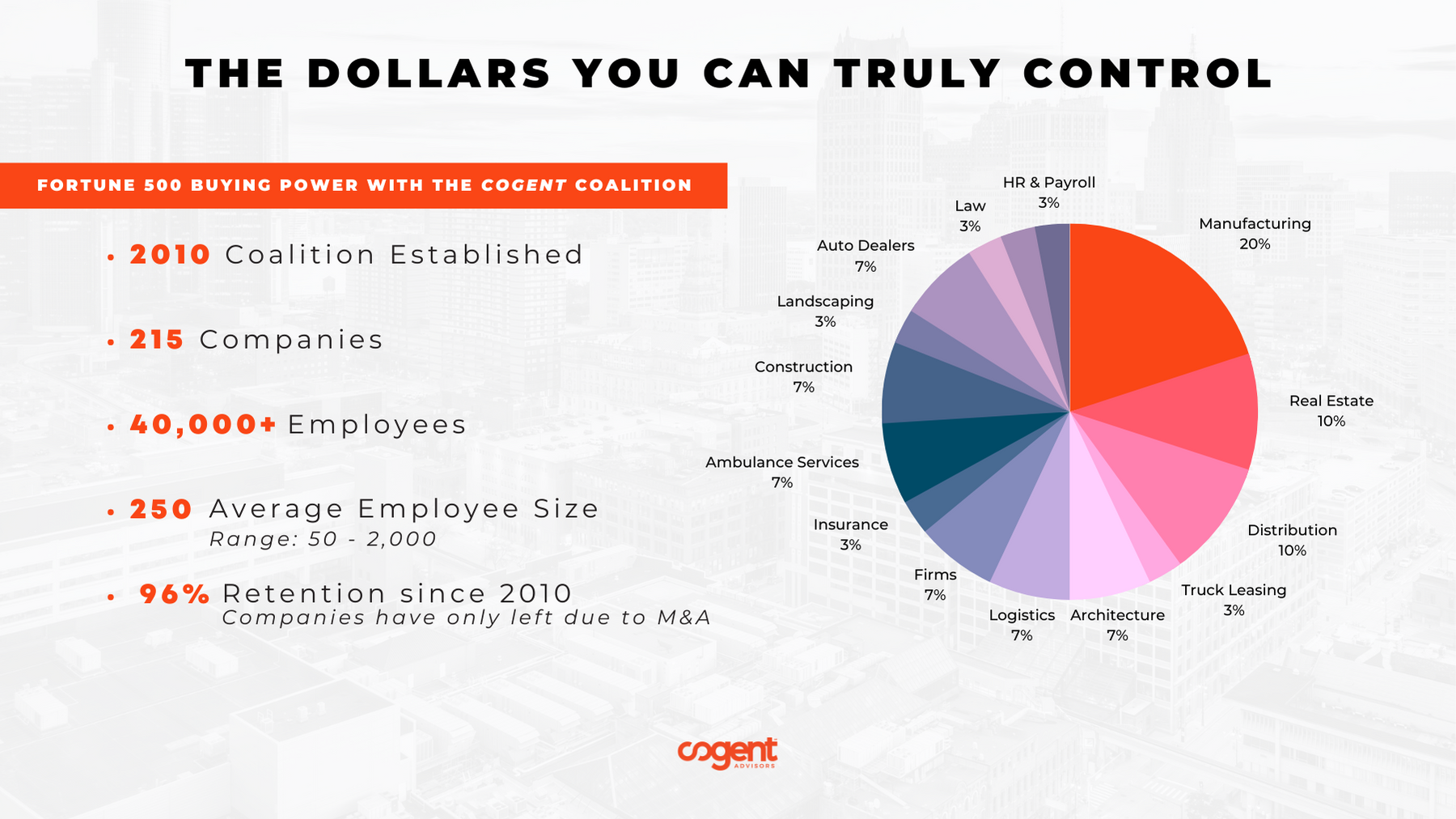

Proprietary Purchasing Coalitions

Unique Employee Benefits Programs: Providing organizations with the buying power of Fortune 500 companies.

Employee Benefits

Fully-Insured Healthcare: We can provide various health insurance plans for any industry.

Behavior Analytics

Health-Related Behavior Analytics: Providing transparent clarity about what is truly driving claims expense.

Strategic Advisory

Consulting: We help organizations with the development and implementation of various objectives and strategies.

Purchasing Coalitions

A Message from our CEO

It is our pleasure to have the opportunity to explore a relationship with you.

As mentioned above, we accomplish the mutually agreed upon goals with our clients per the plan we outline at the outset of every relationship.

Our goal at the end of their year is always threefold;

- Help improve the enterprise value of the organization

- Earn advisory level trust with the team

- Deliver an exceptional client experience so the client’s team becomes raving fans of our team

If the information so far has resonated with you, and you believe you deserve more, then reach out to me personally or contact us via phone, email, social media, or forms on this site.

Let us show you the possibilities when we are Driven Together℠.

Shawn D. Spencer

Co-Founder & CEO

Cogent Advisors, we are

Driven Together℠